That said low-interest rates in recent years have sustained a high level of household debt 875 of. In 2016 risk premium on lending for Malaysia was 177.

Why It Matters In Paying Taxes Doing Business World Bank Group

The Malaysia 10Y Government Bond has a 4200 yield.

. Interest rates at a historic low of 175 after 125 bps rate cuts in 2020 should also spur the economic recovery. Risk premium on lending lending rate minus treasury bill rate in Malaysia was reported at 17733 in 2016 according to the World Bank collection of development indicators compiled from officially recognized sources. This would allow you as an investor.

Then the investor would need to consider 2 as the risk-free rate of return. 330 and the country risk premium 106. For example the Treasury Bond yields 2 for 10 years.

For example if the current market value is MV 0 100 and dividend forecasts are D 1 4 D 2 4 D 3 4 then a growth rate of 0 results in an implied cost of capital of 4 if the growth rate assumption is 5 the implied cost of capital is 86. Instead a negative spread is marked by a green circle. A formula is used to calculate the risk-free rate.

The risk-free rate is often taken for granted in portfolio construction. IBORs are interest rate benchmarks that underpin over US350t in financial instruments and contracts globally. Malaysia 10-Year Bond Yield Historical Data.

Click on the values in Current Spread. Malaysia 10 Years Bond Spread. Risk-Free Rate Of Return.

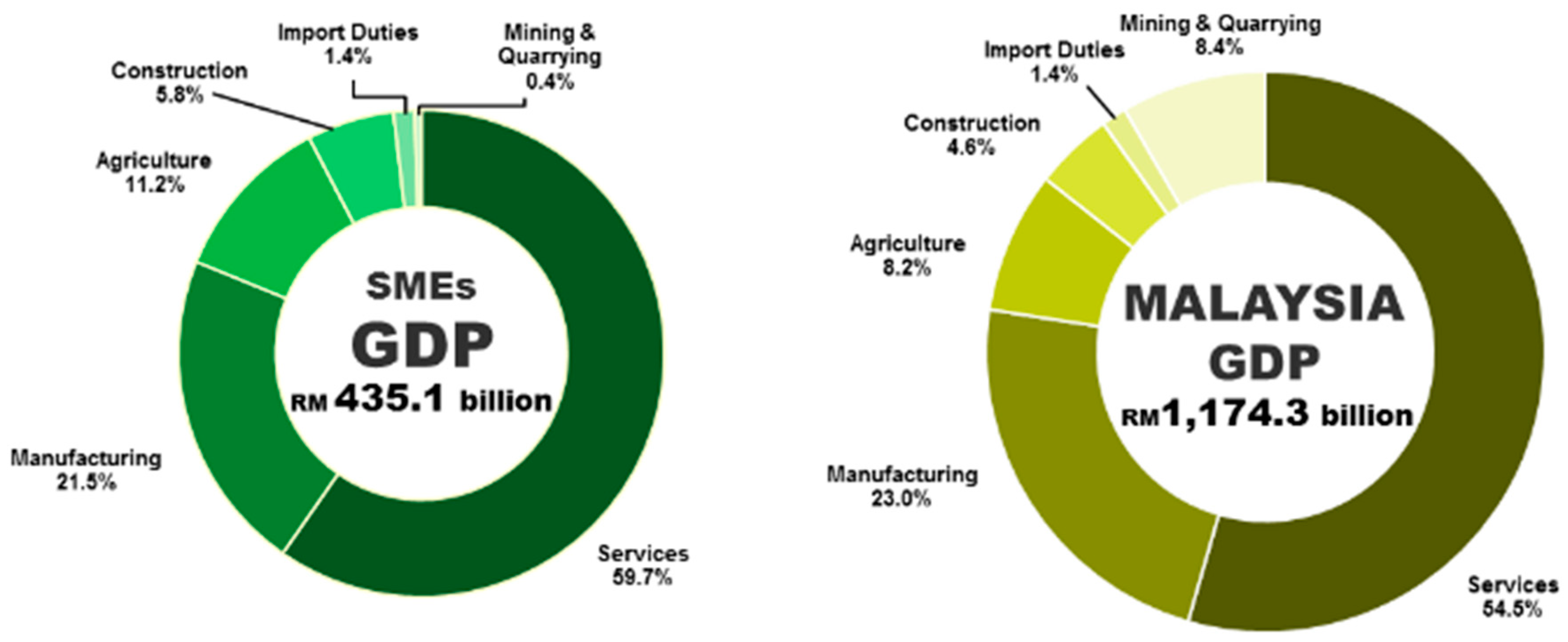

Malaysia - GDP in billions Malaysia - Adjusted Default Spread. The risk-free rate is used in the calculation of the cost of equity as calculated using the CAPM which influences a business weighted average cost of capital. Malaysia - Upper medium grade A1A2A3.

For example data published on 2018-Jan considered as 2018 similarly 2019-Jan as 2019. KUALA LUMPUR March 23. Click on Spread value for the historical serie.

The Malaysia credit rating is A- according to Standard Poors agency. A positive spread marked by means that the 10 Years Bond Yield is higher than the corresponding foreign bond. The value of a risk-free rate is calculated by subtracting the current inflation rate from the total yield of the treasury bond matching the investment duration.

This clearly has painful implications for anyone doing corporate finance or valuation where expected returns often have to be estimated for periods ranging from one to ten years. The graphic below illustrates how changes in the risk-free rate can affect a business cost of equity. 1 I use the local currency sovereign rating from Moodys.

The transition away from IBORs to alternative nearly risk-free rates RFRs will impact. To estimate the long term country equity risk premium I start with a default spread which I obtain in one of two ways. It is the hypothetical rate of return.

Malaysia Government Bonds - Yields Curve. With that said Malaysia Expected Return on Stocks962021 is 740 which is the total of Malaysia ERP and risk free rate. The risk-free rate of return is the theoretical rate of return of an investment with zero risk.

CAPM Re Cost of Equity. Risk premium on lending of Malaysia fell gradually from 422 in 1997 to 177 in 2016. Malaysia - Equity Risk Premium.

GlobalEDGE - Your source for business knowledge Menu. As the graph below shows over the past 40 years this indicator reached a maximum value of 811 in 1986 and a minimum value of 146 in 2014. Risk premium on lending lending rate minus treasury bill rate The value for Risk premium on lending lending rate minus treasury bill rate in Malaysia was 179 as of 2016.

MGS are fixed-rate coupon bearing bonds with bullet repayment of principal upon maturity while coupon payments are made semi-annually. The risk-free rate represents the. In practice it does not exist because every investment has a certain amount of risk.

Risk premium on lending is the interest rate charged by banks on loans to private sector customers minus the risk. Allocations for investors may even be determined completely ignoring this rate of return with the assumption that whatever assets are not invested in the primary portfolio of stocks bonds and alternatives are simply held in a bank account money market funds or short-term Treasuries. Just recently Bank Negara Malaysia BNM announced that they had cut the overnight policy rate OPR for the fourth time this year now to a record low of 175 the lowest since 2004.

The risk free rate for a five-year time horizon has to be the expected return on a default-free government five-year zero coupon bond. Risk premium on lending is the interest rate charged by banks on loans to private sector customers minus the risk free treasury bill interest rate at which short-term government securities are issued or traded in the market. Bank Negara Malaysia BNM said today the central banks Shariah Advisory Councils SAC ruling on the adoption of risk-free rate RFR as an alternative benchmark rate to the London Interbank Offered Rate LIBOR came into effect immediately yesterday March 22 upon publication of the ruling on BNMs website.

It is the government bonds of well-developed countries either US treasury bonds or German government bonds. Naively applied it can have a huge impact on implied cost of capital estimates. The Malaysia 10 Years Government Bond has a 4245 yield.

Beginning December 2006 BNM has also introduced Callable MGS which provides the Government of Malaysia with the option to redeem the issue at par by giving an advance notice of five business days to the bond. A risk-free rate is the minimum rate of return expected on investment with zero risks by the investor. Bank Negara Malaysia and ETP Bursa Malaysia Bonds Sdn Bhd as from 10 March 2008 Government Securities Yield 2006-2018 Click here to view the Government Securities Yield for various tenures 2006-2018.

The risk free rate is computed by calculating the difference between Malaysia 10 year treasury rate trading yield closing on 9 June 2021. Current 5-Years Credit Default Swap quotation is 5719 and implied probability of default is 095. Central Bank Rate is 200 last modification in May 2022.

Malaysia - Country Risk Premium added to mature market premium Malaysia - Corporate Tax Rate. As a move to stimulate the economy in a COVID-19 world OCBC Treasury Research economist Wellian Wiranto said to The Edge Markets that this is a testament. The ending of Interbank Offered Rates IBORs will likely lead to significant changes across a broad suite of financial products and markets.

Rf Risk-Free Rate.

Retirement In Malaysia What Are The Financial Benefits For You Retirepedia

Global Nutrition Report Country Nutrition Profiles Global Nutrition Report

Characterisation Of Covid 19 Deaths By Vaccination Types And Status In Malaysia Between February And September 2021 The Lancet Regional Health Western Pacific

2020 E Commerce Payments Trends Report Malaysia Country Insights

Risk And Capital Requirements For Infrastructure Investment In Emerging Market And Developing Economies

Bursa Stock Talk Getting Risk Free Rate And Market Return In Malaysia

Malaysia Introduction Globaledge Your Source For Global Business Knowledge

2020 E Commerce Payments Trends Report Malaysia Country Insights

Malaysia Economic Transformation Advances Oil Palm Industry

2020 E Commerce Payments Trends Report Malaysia Country Insights

Sustainability Free Full Text Role Of Social And Technological Challenges In Achieving A Sustainable Competitive Advantage And Sustainable Business Performance Html

2020 E Commerce Payments Trends Report Malaysia Country Insights

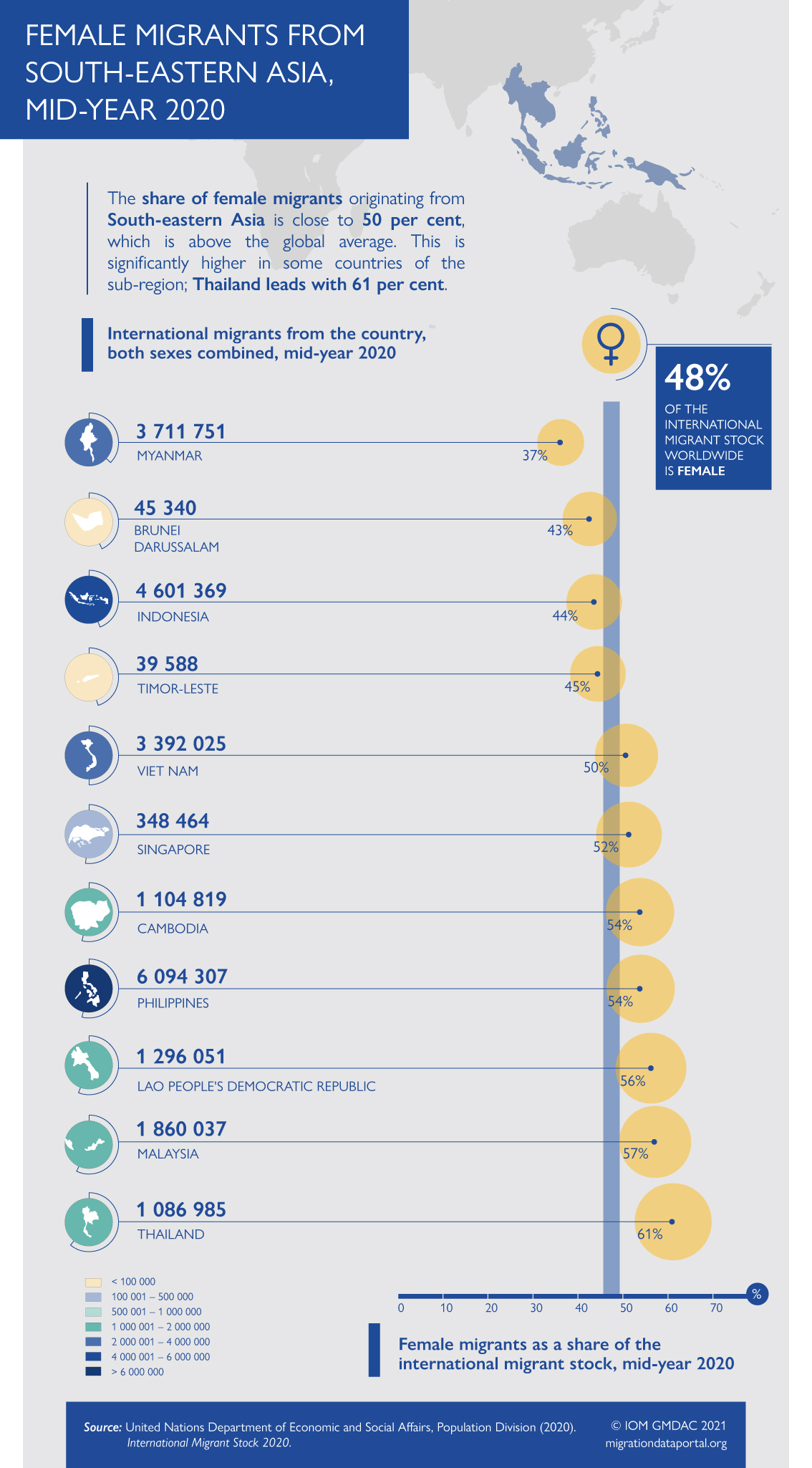

Migration Data In South Eastern Asia Migration Data Portal

How Blaming Others Dominates Indonesian And Malaysian Twitterspheres During Covid 19 Pandemic

Cessation Of Libor Referencing Contract Issuance Bank Negara Malaysia

Knowledge Acceptance And Perception On Covid 19 Vaccine Among Malaysians A Web Based Survey Plos One

Bursa Stock Talk Getting Risk Free Rate And Market Return In Malaysia

Malaysia Economic Transformation Advances Oil Palm Industry

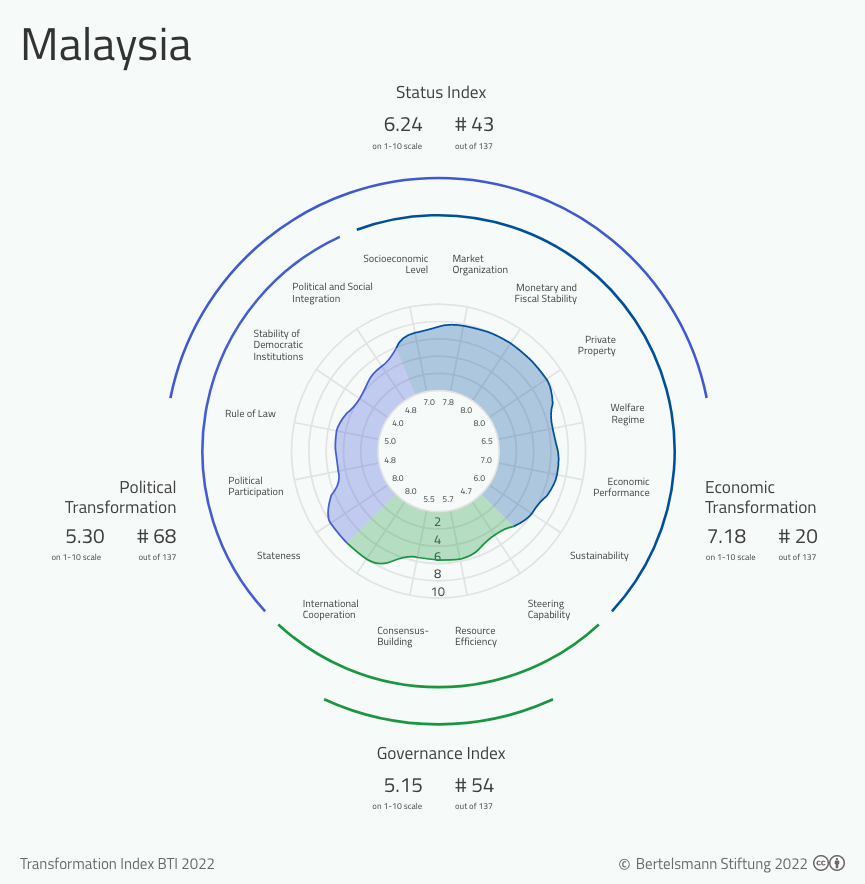

Bti 2022 Malaysia Country Report Bti 2022